Corporate reputation is hard won and easily lost. Over several decades, Tim Hortons extended its franchise-based quick service food business into almost every community in Canada. It built a loyal following for quality products and service at a fair price, gained strong community support for its Summer Camp programs and minor league sports, and was recognized as both a reasonable employer and investment.

“Timmies” became a pre-eminent Canadian success story occupying the top spots in Canadian surveys of overall corporate reputation, including Innovative Research’s panel of 5 companies in the quick service food sector. “Double-double” became a popular Canadian expression and Tim Hortons restaurants became a required stop for campaigning politicians who wanted to be seen with the average Canadian. It was even a necessary addition to the commissary for Canada’s troops serving in Afghanistan. When “sold” in 2014, Tim Hortons was one of the most admired companies in Canada.

Since that time, things have changed. Tim Hortons was acquired by the private-equity group 3G Capital and was merged into a new public company called Restaurant Brands International. RBI also owned the Burger King chain and in 2017 acquired the Popeye’s Louisiana Kitchen chain. Since 2014, new RBI management have focused on increasing Tim Hortons operating margins by reducing overhead and operating costs, slashing senior and middle management ranks (seasoned and expensive), lowering budgets, and imposing new levels of austerity. These and other changes resulted in a nasty public squabble with a large group of Tim Hortons Canadian franchisees and unprecedented media reports of intra-company friction.

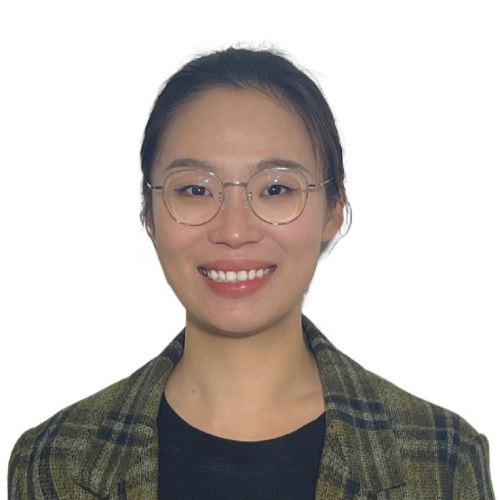

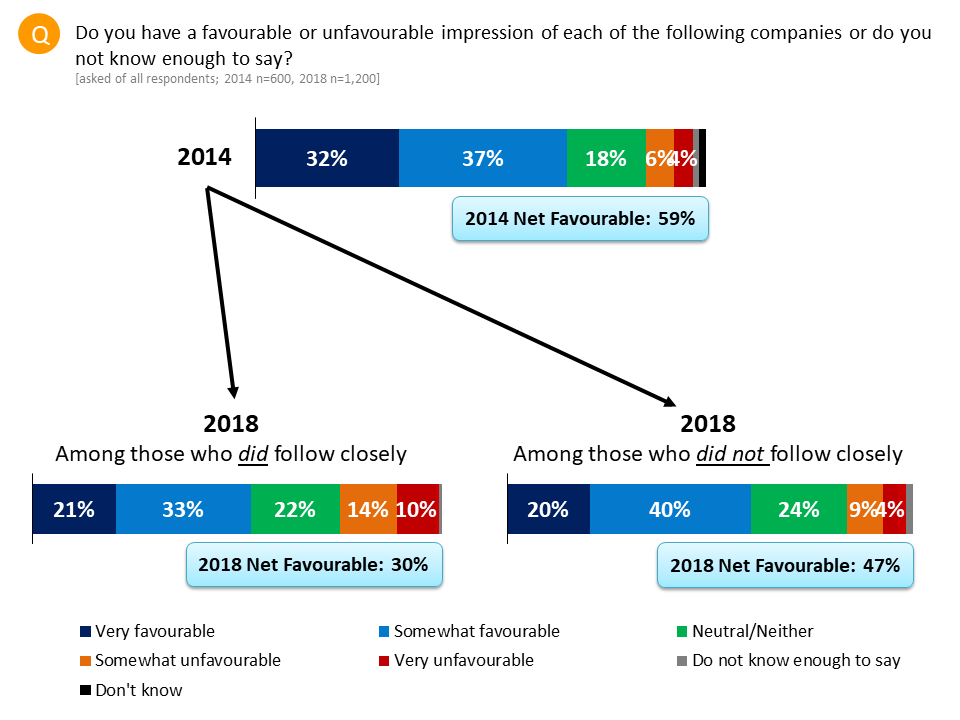

How did Canadians react? Comparing Innovative Research’s surveys of our panel of five quick service restaurant chains from 2014 and early 2018, Tim Hortons overall net favourability declined a weighty 22 points; significantly worse than any of its competitors in our study.

Other recent research confirms Tim Hortons relative “fall from grace” as it sinks from the top of corporate and brand reputation tables. Constant controversy eventually has an impact on opinion and reputation and commercial operations. Margin growth in Canada has stalled for more than a year while promised growth in international markets lags.

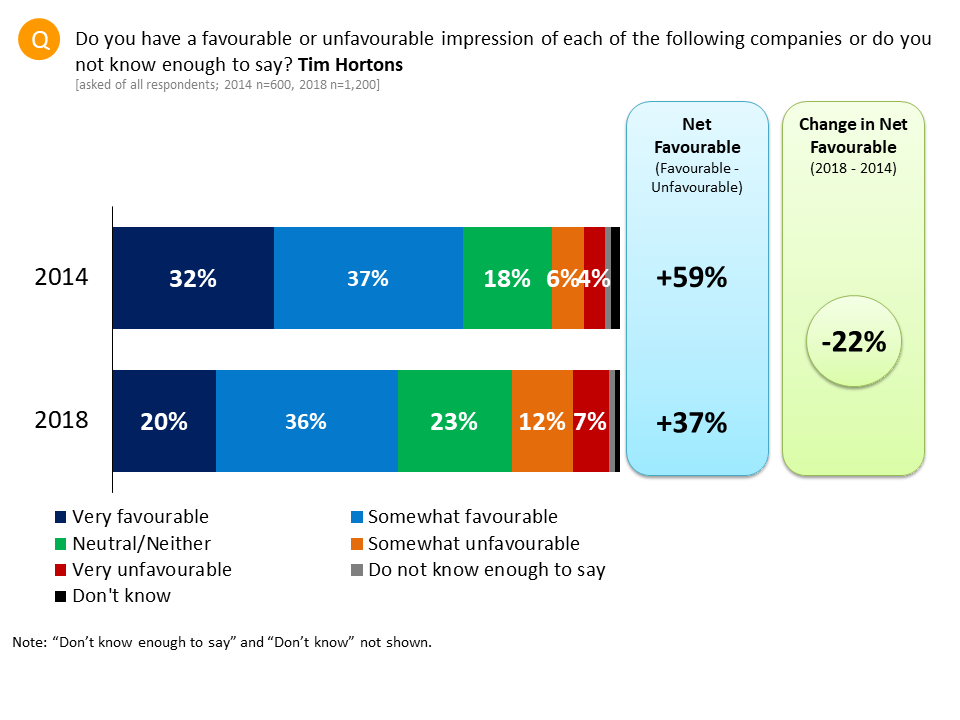

In early 2018 a media storm erupted when a prominent Tim Hortons franchisee chose to reduce his employee privileges, benefits and work schedules when forced to implement Ontario’s significant new minimum wage increase. Passing the costs on to those whom the increase was designed to help was framed as unfair and unethical by interest groups and media commentators.

When the story was reported broadly across Canada, Innovative Research decided to do a deeper dive on the impact of this prominent public affairs issue on Tim Hortons declining reputation. The results show that the impact was significant.

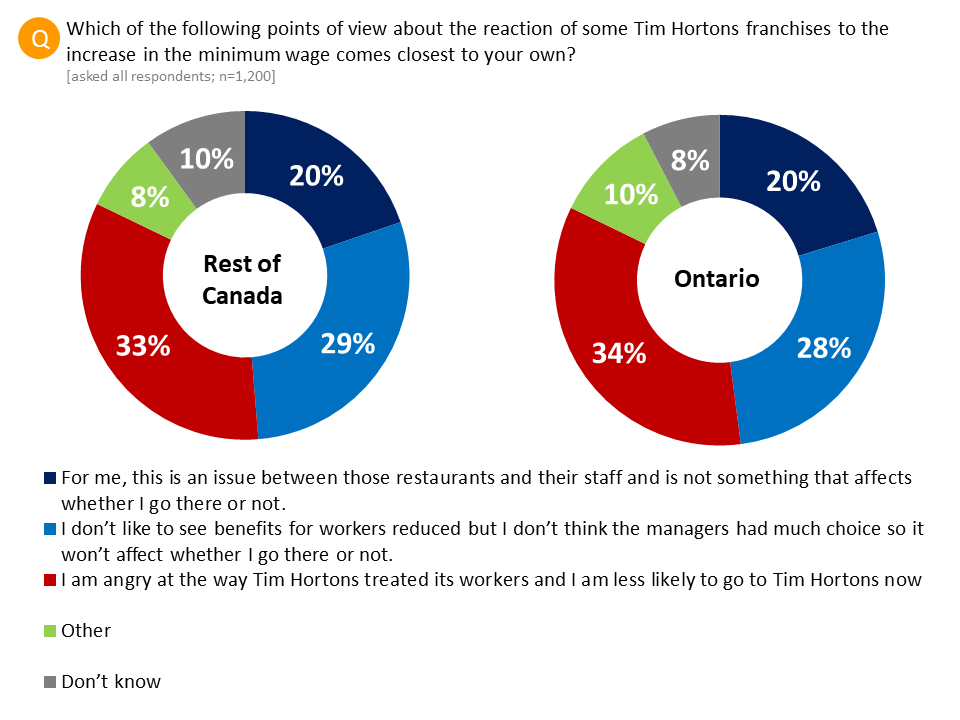

We segmented Canadians into two broad groups – those who followed the issue closely and those who didn’t, and we further separated opinion between Ontario and the Rest of Canada respondents. While the issue was regionally situated in central Ontario, media coverage had been wide spread.

Nearly 3 in every 4 Ontarians (77%) said they very following the issue closely and almost half (49%) in the Rest of Canada paid close attention to the broader issue. Nearly as many respondents said they were following the specific Tim Hortons controversy (72% in Ontario and 50% in ROC). What could have been dealt with as a regional issue quickly became national in scope.

If most people were following the controversy closely what impact did the company’s handling of the issue have on people’s view of Tim Hortons reputation? For those who didn’t follow closely the net favorability (47%) were much more positive than for the controversy followers. For the latter both attention to the issue and specifically to the Tim Hortons controversy drove Tim Hortons’ net favorability down to 30%. That is a significant gap.

Further analysis comparing opinion of Tim Hortons and its peers in our index shows that the controversy had largest impact on perception of Tim Hortons as a good employer (-10%). Further those who followed the controversy rated Tim Hortons lower on most brand attributes relative to peers. And again, relative to peer performance the impact on Tim Hortons brand was highest in Alberta, not Ontario, among men 13-34, and women 55+.

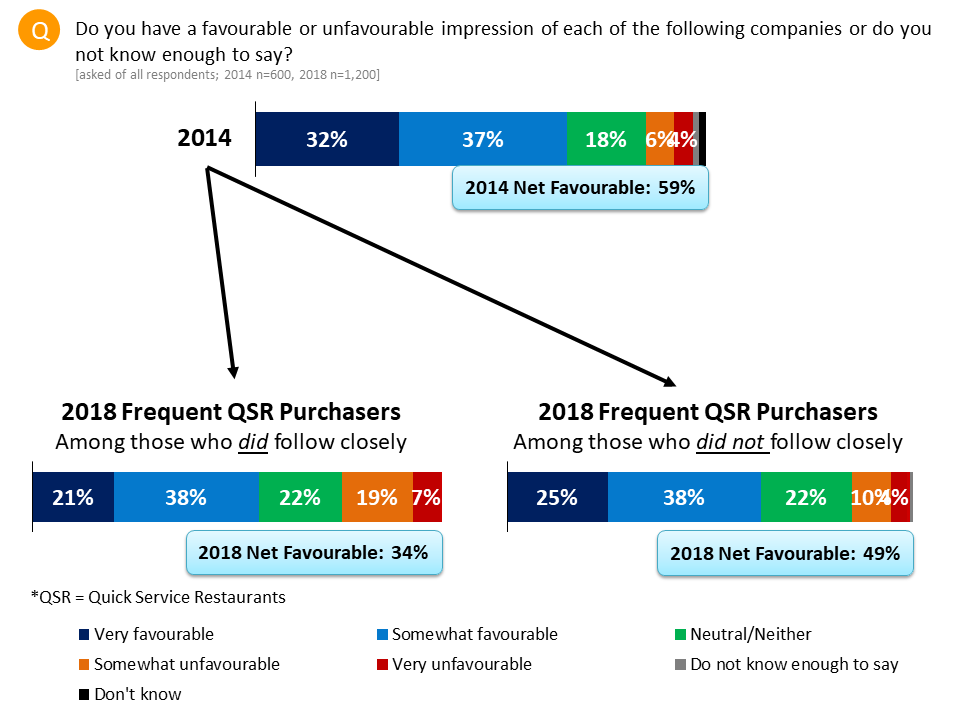

The last slide segments attitudes by frequency of visits to quick service restaurants. When we look at only those who have followed the controversy, unfavourable attitudes to Tim Hortons increase as frequency of visits diminish. Unfavourable opinion of a single brand is comingled with unfavourable opinion of the sector. As these respondents would not normally be customers this provides some comfort commercially for Tim Hortons. However, it is a slippery slope for their corporate reputation.

The irony of a great corporate reputation is that it penetrates beyond your commercial footprint and your brand loyal customers. That corporate reputation is not “owned” by the company – in the end it is rooted in the perceptions and opinions of many “audiences.” The greater the reputation the more it resides in stakeholder groups like governments, communities and the media, less attached than immediate your stakeholders like employees, customers, suppliers, and investors. The halo effect of a great corporate reputation lessens transaction costs in the non-market environment. Broader stakeholders want to associate with companies that have stellar reputation. People want to work there, want you to locate in their communities, want to pass laws and regulations that help your business succeed.

Consequently, for a company like Tim Hortons it matters whether a public affairs issue negatively impacts your reputation with non-customers, governments, communities and the media. An iconic corporate reputation is fragile and easily lost, even if the basic business remains profitable.

Our ongoing research indicates that difficult news in the aftermath of the RBI takeover (lay-offs, changes to operations, budget reductions) and ongoing squabbles with franchisees risked damaging the company’s performance and corporate reputation. But getting on the wrong side of a public affairs controversy like the minimum wage issue can quickly and broadly make a bad problem worse.

METHODOLOGY

These are the findings of an Innovative Research Group (INNOVATIVE) poll conducted from February 19th to 26th, 2018.

This online survey of 2,344 adult Canadians was conducted on INNOVATIVE’s Canada 20/20 national research panel with additional sample from Survey Sampling International, a leading provider of online sample. The results are weighted to n=1,200 based on the most recent Census data from Statistics Canada.

Where possible, the results of this research are tracked back to another INNOVATIVE online poll conducted from September 19th to October 6th, 2014. The 2014 survey had a total national sample size of 2,500, 600 of whom were asked about fast food restaurants.

The Canada 20/20 Panel is recruited from a wide variety of sources to reflect the age, gender, and region characteristics of the country as a whole. Each survey is administered to a series of randomly selected samples from the panel and weighted to ensure that the overall sample’s composition reflects that of the actual Canadian population according to Census data to provide results that are intended to approximate a probability sample.

INNOVATIVE provides each panellist with a unique URL via an email invitation so that only invited panel members are able to complete the survey, and panel members can only complete a particular survey once.

This is a representative sample. We have set targets to ensure we properly reflect key regional and demographic distribution and then used weights to ensure we reflect the country properly. However, since the online survey was not a random probability-based sample, a margin of error can not be calculated. The Marketing Research and Intelligence Association prohibits statements about margins of sampling error or population estimates with regard to most online panels.

Detailed tables: For all surveys, complete results as well as additional methodological details, are available upon request.